Global Luxury Residential

Real Estate Report

Produced by Wealth-X &

Sotheby’s International Realty

![]() Wealth-X, the world’s leading ultra high net worth (UHNW) intelligence and prospecting firm has joined forces with Sotheby’s International Realty, the global leader in luxury real estate to produce the first report analyzing the trends in the UHNW’s practices regarding the acquisition and ownership of global luxury residential real estate properties.

Wealth-X, the world’s leading ultra high net worth (UHNW) intelligence and prospecting firm has joined forces with Sotheby’s International Realty, the global leader in luxury real estate to produce the first report analyzing the trends in the UHNW’s practices regarding the acquisition and ownership of global luxury residential real estate properties.

The Wealth-X and Sotheby’s International Realty Global Luxury Residential Real Estate Report looks at the global ownership of luxury residential real estate across all of the continents and evaluates the generational transfers of wealth and their impact on the investment in real estate.

Key findings from the report include:

• The world’s ultra high net worth (UHNW*) population totals 211,275, and these individuals each own, on average, 2.7 properties.

• US$2.9 trillion of the world’s UHNW wealth is held in owner-occupied residential real estate assets.

• 79% of the world’s UHNW individuals own two or more properties and just over half of them own three or more residences.

• UHNW individuals are increasing the number of properties they hold outside their home countries with the United States, United Kingdom and Switzerland being the three favorite locations.

• Over 7% of the world’s UHNW population have made their wealth through the real estate industry, up from 5% in 2013.

• The UHNW Residential Real Estate Index shows a 8% increase in the value of UHNW-owned residences globally in the past year.

• The United States is the most popular country for foreign UHNW individuals looking to buy secondary residences.

• New York is the city with the highest number of UHNW-owned residences in the world.

• Monaco has the highest density of foreign-owned UHNW residences – 83%.

• Female UHNW individuals value real estate assets more than their male counterparts, holding 16% of their net worth in such assets compared to less than 10% for men.

• UHNW Chinese and Russian multiple homeowners are typically self-made and young – these two clusters are becoming increasingly important buyers of luxury residential real estate around the world.

• Over 6% of the world’s UHNW population is made up of expatriates – those individuals who are currently based outside their home countries. These individuals are stimulating residential real estate demand in their home countries’ markets – for example, India’s non-resident population is increasing demand in Mumbai’s residential real estate market.

According to David Friedman, President of Weath-X, “Wealth-X is pleased to partner with the Sotheby’s International Realty brand for this inaugural report, which underscores Wealth-X’s commitment to conducting groundbreaking research on the world’s ultra high net worth (UHNW) population. Expert commentary from the Sotheby’s International Realty team complements Wealth-X’s global intelligence on the world’s UHNW population, producing a report that demonstrates a true collaboration between the world’s leading UHNW intelligence provider and the global leader in luxury residential real estate. Luxury residential property is a core component to the anatomy of the ultra affluent at the intersection of their lifestyle and investment.”

Philp White, President and Chief Executive Officer of Sotheby’s International Realty Associates, LLC added,“We believe that a solid investment in real estate is one of the single best factors for building long-term wealth, and that many of today’s ultra high net worth consumers would agree. We are proud to partner with Wealth-X to provide valuable insights into today’s luxury real estate market and the buying behaviors of the ultra high net worth consumer.”

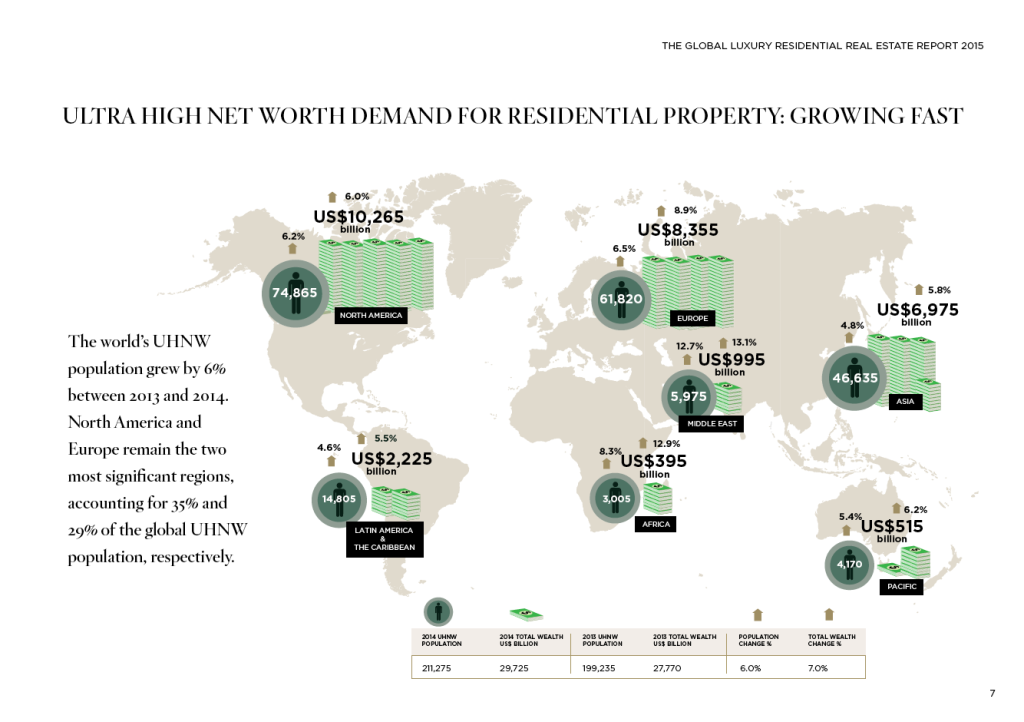

The diagram below shows the strong demand for UHNW residential property across the globe, particularly in North America, Europe and Asia.

Fast growth in emerging markets’ UHNW population and wealth, the global lifestyle of the world’s UHNW population and their flexible purchasing patterns mean that new residential real estate markets around the world will emerge

THE LUXURY RESIDENTIAL REAL ESTATE CUSTOMER

KEY FINDINGS

On average, billionaires own four properties worth US$94 million

UHNW individuals hold 25% of their wealth in cash

Fast growth in luxury real estate demand expected

US$2.9 trillion is held in owner-occupied residential real estate

Typically UHNW individuals hold their primary properties 15 years and their secondary properties 10 years

Individuals with inherited wealth hold 17.2% of their net worth in real estate – more than any other subgroup of the UHNW population, but Russian and Chinese buyers are defying this trend

Women value real estate more than men

Over 6% of the world’s UHNW population have relocated to a di!erent country from which they were born

UHNW individuals are as likely to buy on credit as to pay cash when purchasing residential real estate properties

You can download a full copy of the report here: Wealth-X and Sotheby’s International Realty Global Luxury Residential Real Estate Report

TinyURL for this post is: http://tinyurl.com/jimrea-unhw-report-2015

My pledge to you is to professionally handle all of your real estate needs whether it is searching for a new home or property, selling one that you already have or helping you address your real estate needs anywhere in the world. My goal is to make your real estate experience pleasant, productive, focused and hassle free.

Jim Rea, Realtor

Sotheby’s International Realty – Pacific Palisades

(424) 354-0790

Jim@JimRea.com